At retirement when we take our pension from a defined contribution scheme we have a number of options available to us.

The open market option

Tax free cash lump sum

The frequency of payment

Escalation in payments

Spouses provisions

Guarantee periods

Each of these options can be taken in conjunction with any other. However, some of the benefits will defray the initial amount of pension benefit that you would receive should you take a single life pension with no other provisions.

The Open Market Option

The Open Market Option (or OMO) was introduced as part of the 1975 United Kingdom Finance Act and allows someone approaching retirement to ‘shop around’ for a number of options to convert their pension pot into an annuity, rather than simply taking the default rate offered by their pension provider.

The term OMO is now generally used to support a campaign, often led by the pensions industry and the media, to make sure people know the benefits of shopping around. The majority of people still don’t use the Open Market Option in large part because they don’t know they can or don’t realise the benefits of doing so. Retirees who don’t use the OMO and settle for the default deal offered by their pension provider, may be missing out on up to 20% more income from an annuity. This is especially important as retirees cannot change their annuity once it has been purchased.

One of the main reasons that people can get more from an annuity if they shop around is that they may qualify for what is known as an Enhanced Annuity (sometimes known as an Impaired Life Annuity) which pays a higher income to people who suffer from a range of health conditions – anything from asthma to a serious heart condition. There are also other products available that may suit peoples retirement needs better than the default deal offered by a pension provider. One suggestion to make the most of the Open Market Option is to speak to an independent financial adviser who will explain the different options available at retirement.

Tax Free Cash Lump Sum

At retirement you are permitted to take 25% (a quarter) of your pension fund in as a Tax-Free Cash Lump Sum. In certain circumstances it could be more than this. The Tax-Free cash can be paid by the ceding scheme or the new scheme should you take advantage of your Open Market Option. The remainder will be considered as earned income by HMRC. The amount of tax you pay will depend on your prevailing tax status at the time that you take the pension.

Frequency of Payments

Most pension providers will allow you to take your pension at different Frequencies of Payments, such as annually, quarterly and monthly, sometimes in advance or arrears. Once you have made your decision that is generally how you will continue to receive your income for the rest of your pension annuity.

Escalation in Payment

You can elect to have your pension paid to you at a flat rate for the rest of your life or have it increase in different ways, through Escalation in Payment, typically by 5%, 7.5% etc. Should you choose this option then the initial pension you receive will be significantly reduced but at least you can ensure that your pension retains some degree of inflation proofing.

Spouse’s Provisions

Typically people will purchase a single life annuity but you can elect to provide a pension for your spouse, through a Spouse's Provision should you wish to do so. This at least ensures that should you die in the short term your spouse will continue to benefit from your pension. Spouses pensions can generally be provided at different rates as a percentage of your own, for example 33%, 50% or even 100%. As with all other pension options its best to check what the pension provider is able to offer.

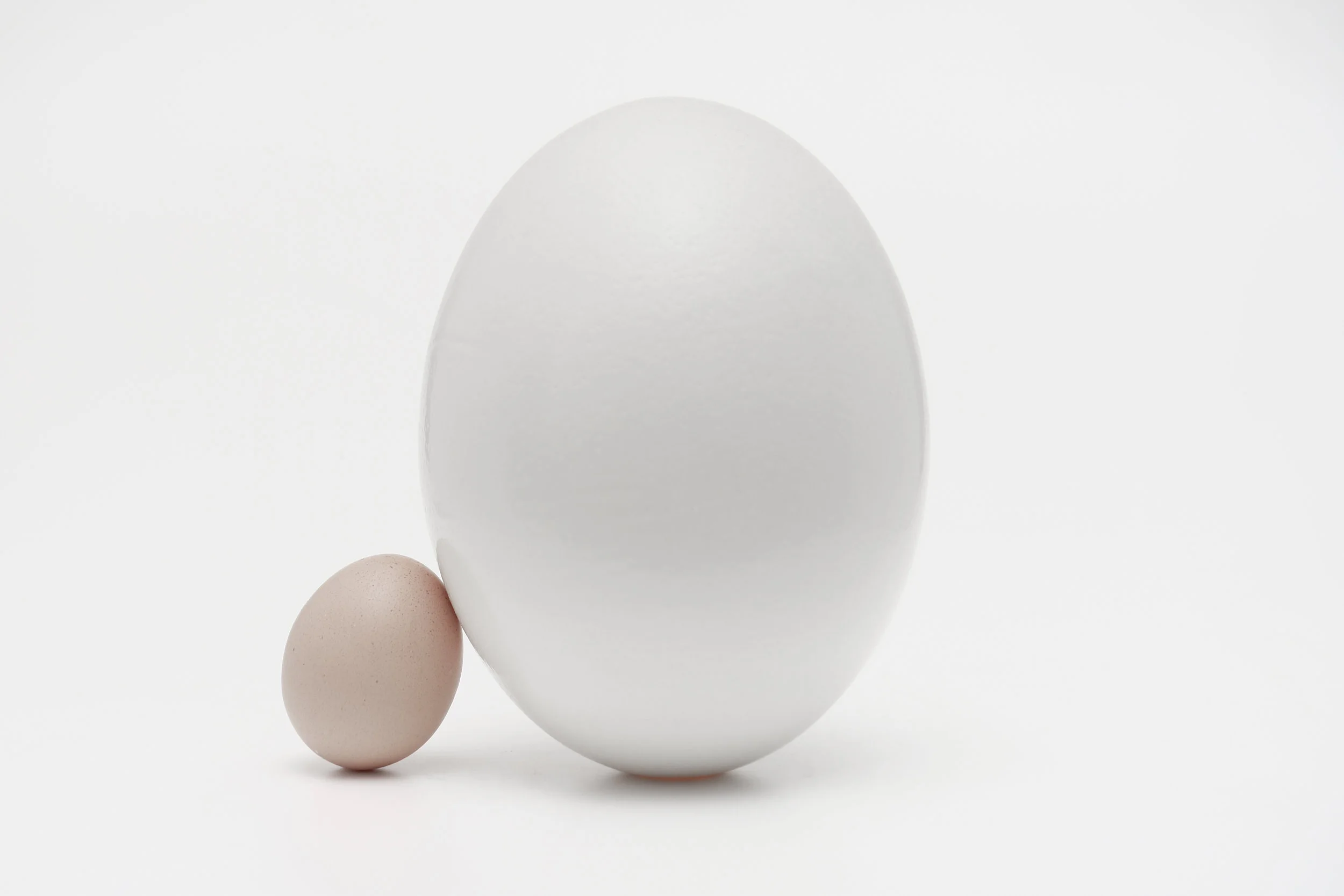

Again this particular option does reduce the amount of initial pension annuity because you are effectively buying two pensions from the same amount of money.

Guarantee Periods

At outset, as with all these options you can elect to take a guarantee period against the pension.

A Guarantee Period can be of different duration, again typically 3, 5 or 10 years. This means that the pension will be paid out to your spouse (or in the event of your spouse predeceasing you, your estate) for the remainder of the term should you die within the guarantee period. For example if you were to take a 10 year guarantee period and then die in year 6 your spouse (or estate) would continue to receive the pension for the remaining 4 year term, after which time, (unless you had provided for a spouses pension) the pension would cease and no other payments would be made.

These options are not offered at the outset of your pension plan as you have no indication at that time what your marital status may be at the time of vesting, the prevailing rates of inflation and your need for tax free cash. Nevertheless the decisions that you make in relation to these options are of great importance both to you and your family should you have one. Moreover once you have made your decisions they cannot be unwound, there are no “U turns”. It is therefore essential that you give consideration to taking professional financial advice at this pivotal and critical time in your financial planning.