Stay safe from pension fraud

Anyone with a pension pot could end up falling victim to pension fraud. You don’t have to be retired or even near retirement – scammers can target you at any age with attractive-sounding offers or investments and trick you into handing over your life savings. The chances of becoming a target are relatively small, but frauds are becoming more sophisticated and harder to spot, so it pays to be vigilant.

By being aware of the risks and taking simple precautions, you can protect yourself and your loved ones from these frauds and scams. Watch out for these warning signs.

Signs that it’s (probably) a pension scam

Somebody contacts you

Real advisers don’t hawk around for trade, so if it’s a cold call, text message or a knock at your door, it’s almost certainly a scam. A clever fraudster might claim to be returning your call, in the hope that you’ve recently contacted a legitimate service or adviser. Always check that an adviser is registered with the Financial Conduct Authority (FCA) or call 0800 111 6768, and call them yourself on the number given on the FCA’s website – not any number the cold caller gives you.

A caller may also claim to be from a government service such as Pension Wise or the Department for Work and Pensions, or something with a similar sounding name. These government services will never call you first, so don’t be fooled.

If you want to call an caller back to verify that it’s really an adviser, do so on a different phone from the one you used to answer their call.

They offer you access to your pension pot before age 55

This is an easy one. Except in very special circumstances (e.g. you are in very poor health) you cannot access your pension before you reach 55. Therefore anyone offering this is asking you to break the law, so by definition they are already a criminal. Just say no. You could also report them to the FCA or to Action Fraud (see below).

They try to hurry you into a decision

A classic trick by rogue traders everywhere is to say a deal is about to expire, so you have to get in quick. This is partly to make sure you don’t have time to hire a bona-fide adviser who could see through their bogus offer.

Couriers are involved

One notorious technique is to cold-call a potential victim, pressure them to sign up for a scheme, and then send round the papers to sign via a courier who does not know anything about the arrangement (and so cannot answer questions). Never sign anything you don’t fully understand or aren’t fully comfortable with. Search for an independent financial adviser to go through any paperwork in detail.

They are hard to contact

Make sure you have a full postal address and landline telephone number for them, and do your best to verify both are genuine. If all you have is a website, mobile number and/or PO box address, be very suspicious. It’s also a bad sign if you find it hard to call a firm back for any reason.

The scheme they are offering sounds convoluted or exclusive

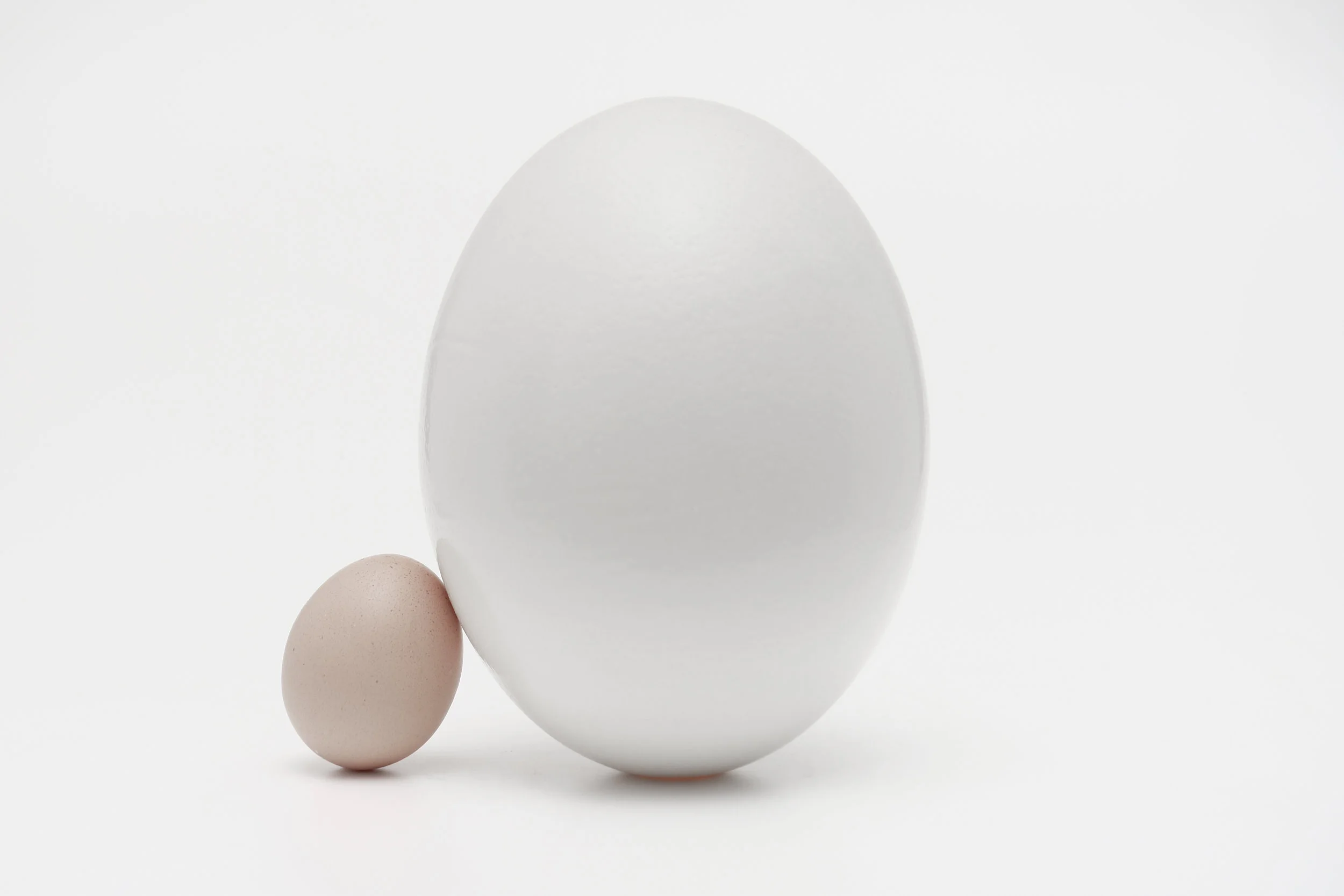

Most genuine investments are surprisingly straightforward. If someone offers you surprisingly high returns, tax ‘loopholes’ or special overseas investments, be extremely wary. Similarly, don’t put all your eggs in one basket – a genuine adviser will always recommend diversifying your portfolio.

They use certain giveaway phrases

A scam will often be disguised under phrases such as ‘pension loans’, ‘upfront cash’, ‘one-off pension investments’ or ‘free pension reviews’. Genuine financial advisers do offer free pension checks – you can find them here. Generally, avoid any offer that sounds too good to be true – you will almost certainly lose money, not gain it.

Finally, there is always the possibility of encountering a scam that no-one has seen before. You can find more anti-fraud tips at the UK Care Guide. The best protection against being caught out by a new fraud is only ever to use an FCA-regulated financial adviser whom you have engaged yourself.

What to do if you suspect a scam

If you think you have been the victim or the target of a scam, you can call the FCA free on 0800 111 6768. If you may have already lost money to a fraudster, contact Action Fraud on 0300 123 2040 or visit www.actionfraud.police.uk.